DENVER (KDVR) — The filing deadline to submit 2022 tax returns or an extension to file and pay tax owed this year is April 18 instead of April 15 due to Emancipation Day in Washington, D.C. The holiday falls on April 17.

If you have already filed your taxes and are waiting for your refund, here’s how you can track it in Colorado.

Track your refund online

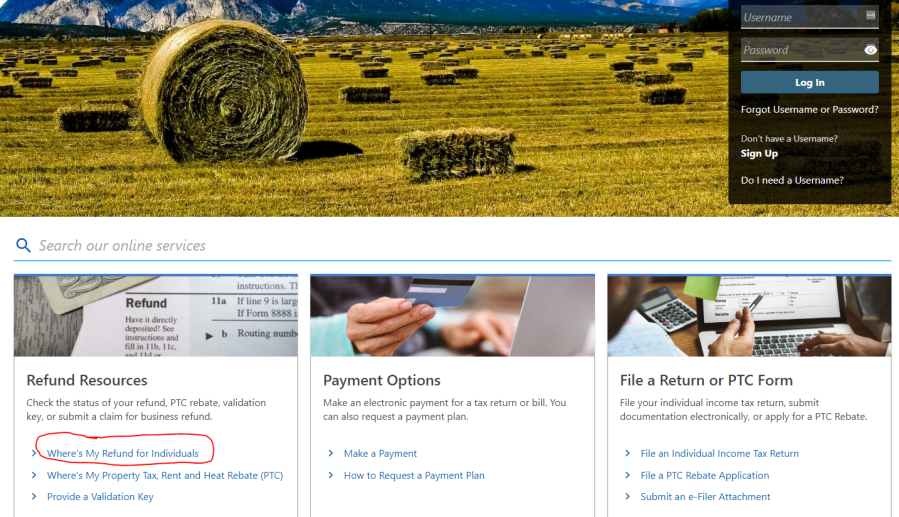

You can check the status of your Colorado refund by using the Colorado Department of Revenue’s revenue online service.

- Once you’re on the webpage, you can scroll down and select the section for refund resources and select ‘Where’s My Refund for individuals’

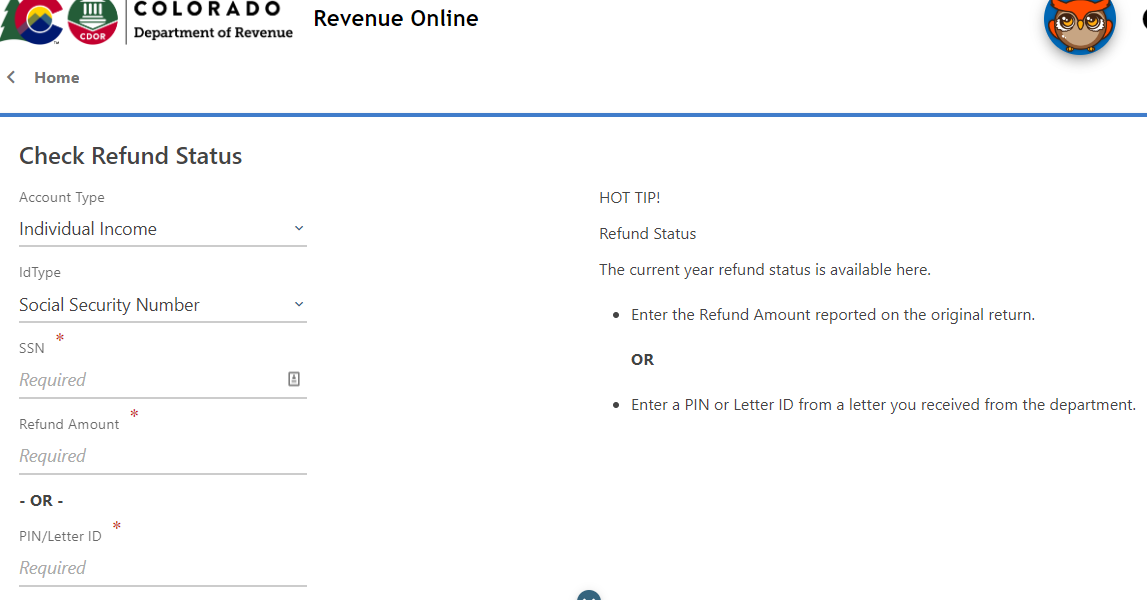

- The next webpage will bring you to the section where you can check your refund status

On this screen, you will just need to enter your Social Security Number or your Individual Tax Identification Number. Then you can type in the amount of your refund.

If you don’t know the amount of your refund, you can either use a letter ID number from a recent income tax correspondence or you can request a letter ID that you will receive within seven to 10 business days.

Once you have the letter ID or your refund amount, you can select ‘get my refund’ and it will show you where your refund is in the process.

The Colorado Department of Revenue said that you will receive the same information online as you can get from the call center and you won’t have to wait on hold.